dupage county sales tax vs cook county

To review the rules in Illinois visit our state-by-state guide. Illinois taxes individual income at a rate of 495 and business income at 7.

For Romney And Santorum A Battle Of Chicago Versus Illinois Fivethirtyeight

Keep in mind that low property tax rates dont mean a county is the best place to invest in nor do high property tax rates mean a county should be out of the running.

. Recently I looked online at a 2 flat in a Cook County suburb and nearly fell out of my chair when the real estate agent told me what the property taxes were. Payments must be received at the local bank prior to close of their business day to avoid a late payment. Dupage County Has No County-Level Sales Tax.

People are mentioning taxes. The sales tax in Chicago is 875 percent. DuPage County Collector PO.

If youre looking to buy a house the two big numbers youll want to look at are property taxes and quality of. 117 rows A county-wide sales tax rate of 175 is applicable to localities in Cook County in addition to the 625 Illinois sales tax. Taxes might be slightly less there than in towns to the east but not likely by that much.

Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N. The average household in DuPage County last year paid 211 of the value of their single-family home in property taxes or 8000 according to ATTOM Data Solutions. The base sales tax rate in DuPage County is 7 7 cents per 100.

In Illinois the Tax Collector will sell Tax Lien Certificates to winning bidders at the Cook County Tax Lien Certificates sale. Thanks to the DuPage County sales tax reduction the new rate for services and parts is 75 and the new rate for cars is 7. According to state law Illinois Tax Lien Certificates can earn as much as None 18 on the amount winning bidders pay to purchase Illinois Tax Lien Certificates.

The 2018 United States Supreme Court decision in South Dakota v. According to the Office of the Will County Clerk the 2005 average Will County property tax rate. Illinois has a 625 sales tax and Cook County collects an additional 175 so the minimum sales tax rate in Cook County is 8 not including any city or special district taxes.

Some cities and local governments in Cook County collect additional local sales taxes which can be as high as 35. Box 4203 Carol Stream IL 60197-4203. Molding today into tomorrow.

Has impacted many state nexus laws and sales tax collection requirements. At the time the average rate for Cook County including municipal sales tax was about 216 percentage points higher than in DuPage Kane Lake McHenry and Will counties. Compare those numbers to nearby Cook County where youll pay 8 sales tax or Chicago where youll pay 1025.

Now it is true that Indiana counties assess income tax too. Keep in mind that low property tax rates dont mean a county is the best place to invest in nor do high property tax rates mean a county should be out of the running. Dupage county vs cook county1959 nascar standings dupage county vs cook county.

In DuPage County its 675 percent and in Lake. If your main concern is about sales and property taxes Id suggest looking at Kane County and to a lesser extent Kendall County. Lake Zurich being in Lake County wouldnt have the heavy sales-tax burden that Cook County communities have.

What about your take-home pay. In Cook County outside of Chicago its 775 percent. Heres how Cook Countys maximum sales tax rate of 115 compares to other counties around the United States.

The Regional Transportation Authority RTA is authorized to impose a sales tax in Cook DuPage Kane Lake McHenry and Will counties. Metro-East Park and Recreation District Tax The Metro-East Park and Recreation District tax of 010 is imposed on sales of general merchandise within the districts boundaries. Lowest sales tax 625 Highest sales.

Cook has higher sales taxes but both Cook and DuPage have higher property taxes depending on which town youre in. Registered tax buyer check-in begins at 800 am. County Farm Road Wheaton IL 60187.

Beginning May 2 2022 through September 30 2022 payments may also be mailed to. The base sales tax rate in DuPage County is 7 7 cents per 100. These rates were based on a tax hike that dates to 1985.

0610 cents per kilowatt-hour. In DuPage County property tax rates vary widely between suburbs with 2005. Compare that to Indiana which has an individual rate of 323 and a business rate of 575.

1337 rows 2022 List of Illinois Local Sales Tax Rates. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption. The Dupage County sales tax rate is.

So if a county website says the average tax rate for the county is 75 per hundred dollars of value a builders sales rep will probably say that the rate is 25 25 per hundred dollars of sale price 13 of 75. Dupage county vs cook. In Lake County Indiana which borders Cook County Illinois the county tax rate of 15 will take you up close to the state tax but still not equal it.

That rate is nearly double the. I am in Dupage and my property taxes have ranged between 15 and 25 depending on market conditions and school funding needs for single family detached as well as condo properties I have owned. By Annie Hunt Feb 8 2016.

Cook County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Chicago Property Taxes Lake County Tax Bill

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates

Cook County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

For Romney And Santorum A Battle Of Chicago Versus Illinois Fivethirtyeight

Cook County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Cook County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Cook County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Cook County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

July 1 2021 Increase To Chicago Minimum Wage But No Change To Cook County Minimum Wage Despite Written Notices Smithamundsen Llc Jdsupra

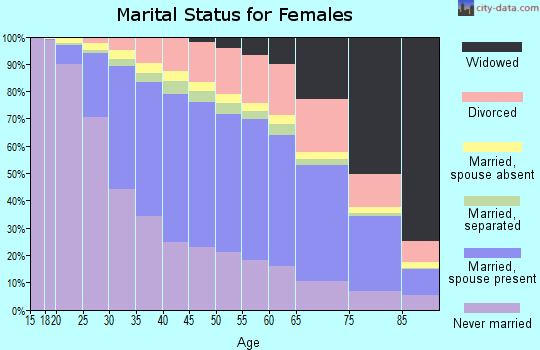

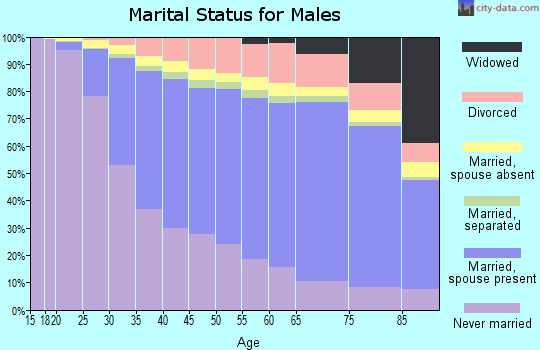

Riverside Illinois Il 60546 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

For Romney And Santorum A Battle Of Chicago Versus Illinois Fivethirtyeight

Cook County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More